Do I need health insurance if I have TRICARE?

Veterans and military families face unique challenges when understanding healthcare options once returning to civilian life. Military benefits do...

2 min read

Action Benefits

:

Jul 21, 2023 12:21:00 PM

Action Benefits

:

Jul 21, 2023 12:21:00 PM

Health insurance is a complex topic, but there are some cheat codes you can use to better understand it. The Affordable Care Act (ACA), also known as Obamacare, introduced a system of metal levels to help you choose a health insurance plans that suits your needs. Let’s take a look at those metal levels, and how they might impact your coverage decisions.

The ACA categorizes health insurance plans into four levels, each represented by a different metal: Bronze, Silver, Gold, and Platinum. These metal levels serve as a way to communicate the coverage and cost-sharing structure of each plan, making it easier for you to understand what you’re getting for your premium dollars.

Bronze plans typically have the lowest monthly premiums but the highest out-of-pocket costs.

They cover about 60% of your healthcare expenses on average, leaving you responsible for the remaining 40%.

Silver plans strike a balance between premiums and out-of-pocket costs.

They cover about 70% of your healthcare expenses on average, leaving you responsible for the remaining 30%.

Gold plans have higher monthly premiums but lower out-of-pocket costs.

They cover about 80% of your healthcare expenses on average, leaving you responsible for the remaining 20%.

Platinum plans have the highest monthly premiums but the lowest out-of-pocket costs.

They cover about 90% of your healthcare expenses on average, leaving you responsible for the remaining 10%.

Selecting the right metal level depends on various factors, including your budget, healthcare needs, and risk tolerance. Here are some considerations to help you make an informed choice:

Monthly budget: If you have a tight monthly budget, a Bronze plan might be more affordable due to its lower premiums. But, you will need a plan for paying the deductible should you incur any health expenses.

Healthcare needs: Consider your health and any anticipated medical expenses. If you expect to need frequent medical care, a Gold or Platinum plan with lower out-of-pocket costs might be a better fit.

Risk tolerance: Assess how comfortable you are with higher out-of-pocket costs in exchange for lower monthly premiums.

Subsidies: Check if you qualify for premium tax credits or cost-sharing reductions based on your income, which can make higher metal levels more affordable. Premium tax credits are available at any metal tier, and reduce your monthly payment. Cost-sharing reductions, which reduce what you pay when you see the doctor, are only available on the Silver tier.

Understanding the metal levels in the Affordable Care Act helps you make better health insurance choices for you and your family. Consider your budget, healthcare needs, and risk tolerance when selecting a metal level. And most importantly, don't hesitate to seek guidance from a trusted health insurance professional who can help you navigate the complex world of healthcare coverage. Your health and financial well-being depend on it.

Veterans and military families face unique challenges when understanding healthcare options once returning to civilian life. Military benefits do...

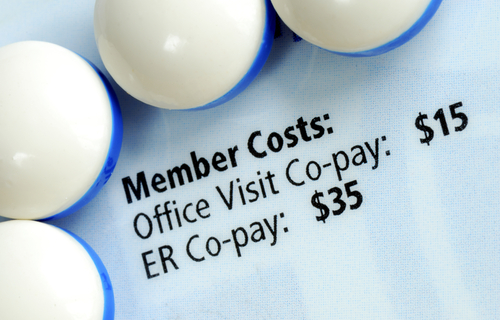

Health insurance is helpful in helping you access needed medical care. But, it’s not always easy to understand the variety of payments you might be...

For a variety of reasons, older Americans may choose to divorce. While there are several considerations that the now-ex-partners should be aware of,...