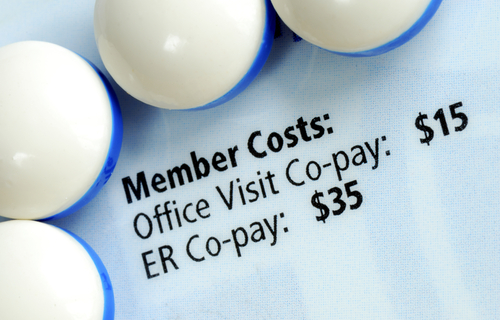

What's the difference between a deductible, copay, and coinsurance?

Health insurance is helpful in helping you access needed medical care. But, it’s not always easy to understand the variety of payments you might be...

3 min read

Action Benefits

:

Jul 17, 2024 1:16:44 PM

Action Benefits

:

Jul 17, 2024 1:16:44 PM

The Inflation Reduction Act of 2022 spurred significant changes to drug costs – at least for Medicare enrollees (sorry, employer groups and Marketplace consumers). In recent years, we’ve seen $35 caps on monthly insulin fills, inflation-based rebates for both Part B and Part D drugs, and consumers have seen the effective elimination of their responsibilities during the catastrophic coverage phase.

But, plan year 2025 promises more changes to Part D benefits. Fortunately, your friendly neighborhood insurance agency is on the case.

For the first time, you can spread your out-of-pocket prescription costs over capped monthly installments, rather than paying everything all at once. Say, for example, you take a higher-than-usual dose of fluticasone/salmeterol to help control asthma symptoms. The list price for a 60-dose diskus of 250mcg/50mcg is right around $444. If your Part D plan has the standard deductible (more on that in a moment), you’ll pay the pharmacy full price the first time you fill it in January.

But, if you enroll in the program by contacting your Part D carrier, you'll owe nothing at the counter. The plan will pay the pharmacy, and you will pay the plan in installments throughout the plan year.

We should note that the plan doesn’t change anything about Part D benefits. You'll still move through the coverage stages. The same things will still count toward your deductible and out-of-pocket threshold. The only difference is how and when you'll pay your cost-sharing responsibilities.

The redesigned benefit does much to simplify Medicare’s coverage phases and to limit out-of-pocket costs. No longer will there be confusion about coverage gaps and donut holes. Instead, there are only three coverage stages – and they’ll feel a lot like what you experience in ACA-compliant drug coverage.

Annual deductible phase: For plans that use the standard design, you'll pay 100% of your covered drug costs until you meet the deductible for that contract year. In 2025, that will be $590.

Initial coverage phase: Once the deductible is satisfied, beneficiaries will pay 25% coinsurance for covered Part D drugs. The plan will pick up 65% of the cost of drugs eligible for a new discount program; the manufacturer would pay the remaining 10% for these drugs. For ineligible drugs, the plan would pay the full 75%. You'll remain in this phase until you reach the annual out-of-pocket threshold. For 2025, that will be $2000.

Catastrophic phase: You'll have no out-of-pocket responsibility at this point. Instead, for eligible drugs, the plan will pick up 60% of the cost; the manufacturer and government will evenly split the remaining 40%. The plan will still pay 60% for ineligible drugs, while the government pays the balance.

The Part D redesign also changes the standard benefit to exempt certain insulins and vaccines from the deductible. In practice, that means cost-sharing for these drugs will function a bit differently than you might expect.

In 2025, if a beneficiary has not satisfied their plan deductible, but has paid enough in TrOOP-eligible costs (hello, $35 insulin fills) to satisfy the standard deductible, they will move into the initial coverage phase.

If the beneficiary uses drugs not subject to deductible or satisfies their plan deductible, but hasn’t paid sufficient TrOOP costs to satisfy the standard deductible, the Part D plan is required to cover what a manufacturer would have owed had the drug been eligible for manufacturer discounts. Then, once the standard deductible is satisfied, the manufacturer and plan will split drug costs as outlined above.

Medicare beneficiaries will have significantly lower out-of-pocket expenses for their prescription drugs in 2025 – a $2,000 cap. And, you'll have the option to spread that cost out over the year with the Medicare Prescription Payment program.

But, these changes do put more financial liability on Part D plans. We’ll likely see premiums rise to help offset those costs. Where permitted, we may see drugs drop off formularies. And, it’s entirely possible we’ll see a rise in utilization management via step therapy, prior authorizations, and moving drugs to higher formulary tiers.

In short, you will be paying less for drugs overall, but it may be harder to get them.

Health insurance is helpful in helping you access needed medical care. But, it’s not always easy to understand the variety of payments you might be...

Medicare Part D is complex, but you literally can't afford not to understand it. Mastering the nuances of Medicare Part D can shield you from late...

Every year, the body governing Medicare in the United States, the Centers for Medicare and Medicaid Services (CMS), reviews the rules surrounding how...