What are metal levels in the Affordable Care Act? Your guide to smart health insurance choices

Health insurance is a complex topic, but there are some cheat codes you can use to better understand it. The Affordable Care Act (ACA), also known as...

3 min read

Action Benefits

:

Sep 29, 2023 11:19:29 AM

Action Benefits

:

Sep 29, 2023 11:19:29 AM

Health insurance is helpful in helping you access needed medical care. But, it’s not always easy to understand the variety of payments you might be responsible for when using your insurance. If you’re going to budget effectively, you’ll need to understand four key parts of your policy: premiums, deductibles, copays, and coinsurance. Let’s dive in!

Premiums

A premium is the amount you pay for your health insurance coverage, usually on a monthly basis. Think of this as your subscription fee – just as you have for Netflix or Amazon Prime. It's a fixed cost you pay regardless of whether you use healthcare services or not. Premiums are your gateway to coverage and medical care.

Deductibles

A deductible is the amount you must pay for covered healthcare services before your insurance plan starts sharing the cost. For example, if your plan has a $1,000 deductible, you'll need to pay $1,000 out of pocket for covered services before your insurance begins paying any bills. However, there is good news here – you’ll only be responsible for paying the price your insurer has negotiated with your healthcare provider.

Copays

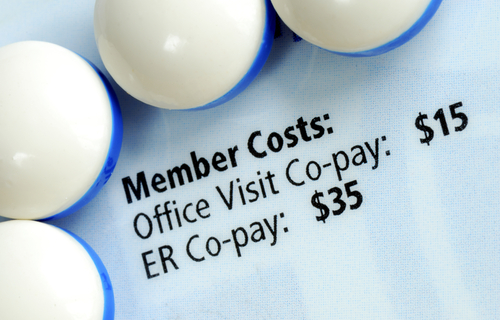

A copayment (copay) is a fixed amount you pay for a specific healthcare service, usually at the time of service. For instance, you may have a $20 copay for a doctor's office visit or a $10 copay for a prescription drug.

Coinsurance is the percentage of costs you pay for a covered healthcare service, calculated after you've met your deductible. For example, if your plan has a 20% coinsurance for hospital stays and the total cost is $1,000, you would pay $200 (20% of $1,000), and your insurance would cover the remaining $800.

Understanding the Relationship

Premiums, deductibles, copays, and coinsurance are interconnected and significantly impact how you manage healthcare expenses. Here's a brief summary of how they relate to each other:

Tips for Consumers

Understanding premiums, deductibles, copays, and coinsurance is key to managing your healthcare expenses. By being informed about these terms, you can make educated decisions regarding your health insurance and navigate the healthcare system with confidence.

Health insurance is a complex topic, but there are some cheat codes you can use to better understand it. The Affordable Care Act (ACA), also known as...

As the landscape of healthcare continues to change, many patients are drawn to the concept of concierge care—an appealing option that promises...

The Inflation Reduction Act of 2022 spurred significant changes to drug costs – at least for Medicare enrollees (sorry, employer groups and...